The Green Dot Platinum Visa® Secured Credit Card is designed for people who are looking to build or rebuild their credit. Like a traditional credit card, you have a credit limit and make monthly payments. The big difference is that you make a refundable security deposit that acts as collateral if you default on payments (starting as low as $200).

Your ability to make the minimum payment determines the credit limit range, and your security deposit sets the limit within that range. Your credit line will equal the amount of this security deposit.

You can build up your credit file with responsible use of your Platinum Secured Credit Card over time. Responsible use includes making on-time minimum payments, keeping your balance low, and paying off your credit card each month. Conversely, if you do not make on-time minimum payments, keep your balance low, and consistently spend to the credit limit, this could have a negative impact on your credit file. Since your activity is reported to the three major credit bureaus every 30 days, it is important you follow these guidelines to maintain and build your credit over time.

With responsible use over time, the Green Dot Platinum secured credit card can help build your credit history since it reports your payments to the three main credit bureaus every 30 days. On-time payments, late payments, purchases, loan terms, credit limits, and balances owed and events such as account closures or charge-offs are also reported and these actions can adversely affect your credit score. Generally, pre-paid cards and debit cards do not report to credit bureaus.

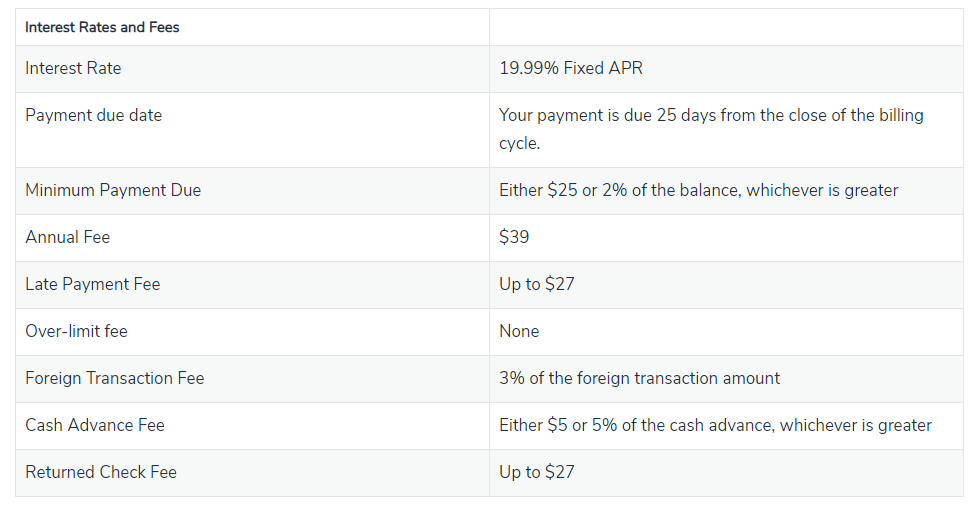

The table below shows the fees that apply to the Green Dot Platinum Visa® Secured Credit Card. Please refer to your Cardmember Agreement for details.

ou can use your credit card everywhere that Visa is accepted. There is a foreign transaction fee of 3% of the amount you spend outside of the United States.

The 5 official factors that determine your credit score according to the United States government are:

The $39 Annual Fee is billed with your minimum payment and due after 30 days.

Please refer to your Cardmember Agreement for details.

If the “New Balance” shown on your monthly Billing Statement is less than $25.00, your Minimum Payment Due will be the New Balance. If the New Balance is $25.00 or more, your Minimum Payment Due will be $25.00 or 2% of the New Balance, whichever is greater. This will also include interest and fees, plus any amount that is past due on your Credit Account.

Please refer to your Cardmember Agreement for details.

Payments will apply to the balance with the highest interests, followed by the fees. Interest will be assessed on a per day basis. Not making your minimum payment in full may cause your account to be delinquent, negatively impacting your credit standing (and credit score) over time.

Please refer to your Cardmember Agreement for details.

A minimum security deposit of $200 up to the amount of your maximum approved credit limit is required for this product. Your actual credit limit will equal the amount of your security deposit.

The security deposit needs to be funded within 90 days from the date your secured credit card was approved. If we do not receive your security deposit within 90 days from the date your card was approved, your account will be closed.

Green Dot will report that an account with a $0 credit line was opened and then closed. If this is your first credit card, this may affect your credit score. If you have had a credit card in the past, this should not affect your credit score.

The quickest method to make your security deposit (any amount up to your approved limit) is at a retail store near you. Click here to find a retailer near you. The credit line will be made available within minutes from the retail store transaction. Up to a $4.95 retail service fee and limits apply.

Please note that you can only make one security deposit at a retail store. If your approved credit limit is greater than $500 and you make your security deposit at a retailer with a limit of $500, you will have to mail a check or money order using the security deposit slip for the difference to get access to your approved credit limit.

You can also submit your deposit using a debit card by visiting www.greendotcredit.com and clicking on the “Make Your Initial Deposit” button. Credit will be available within one business day.

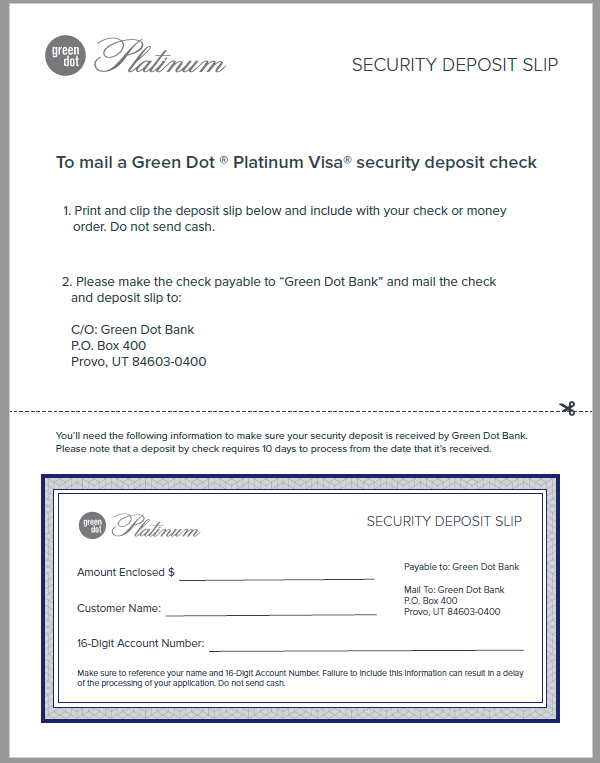

If you mail in a check or money order, there is a 10-day processing hold from the date the check or money order is received. Mail all checks and money orders to:

Green Dot Bank

P.O. Box 400

Provo, UT 84603-0400

Yes, if you pay your balance in full and close your credit card account, your security deposit will be refunded. Call Green Dot Customer Support at 1-866-291-0818 to close your account. We may use the funds in the security deposit to pay any balances on your Credit Account. We also may hold the funds in your Collateral Account for as long as 60 days after you have paid off your Credit Account balance and you Credit Account is closed.

Please refer to your Cardmember Agreement for details.

The security deposit will not earn interest.

Yes. If you’re approved for a credit limit increase, you’ll need to first deposit that amount to your security deposit for the credit limit increase to go into effect.

Green Dot reports your credit standing to the three major credit bureaus every 30 days. Credit standing includes information like whether you make your minimum payment in full and on time every month and whether your card balance is low. A history of good credit standing can help build your credit. However, not making your minimum payments on time each month and other negative use can damage your credit.

If your current security deposit amount is less than your approved credit limit, you can add to your security deposit up to the approved credit limit any time in $50 increments, so long as the amount you add does not cause the total security deposit balance to exceed $5,000. You can do so by debit card on www.greendotcredit.com OR by mailing a security deposit slip along with your check or money order for the additional deposit to:

Green Dot Bank

P.O. Box 400

Provo, UT 84603-0400

If your security deposit already equals your approved credit limit, you can apply for a credit limit increase at www.greendotcredit.com. We’ll first need to check if you’re eligible for an increase, then determine the maximum allowable increase. From there, you’ll need to increase your security deposit to match the new credit limit.

For lost or stolen cards, please call Green Dot Platinum customer support at 1-866-291-0818.

Green Dot Bank supports its military customers by making sure our servicemembers are aware of the federal Servicemembers Civil Relief Act (SCRA), and the benefits it offers. SCRA permits customers on active duty in the United States Military to devote their full attention to service by easing some of their financial obligations. As an active duty member of the United States Military, you may be eligible for SCRA benefits and protections on the Green Dot Platinum Visa secured credit card.

To financially prepare for a deployment, visit the “Preparing for Deployment page” on the Military One Source site for information about how you can financially prepare for deployment.

SCRA’s benefits and protections, such as the interest-rate cap limitation, are intended to protect military personnel who had an existing obligation prior to becoming active duty military, but are less able to manage their finances while in active service.

To qualify for SCRA benefits, all required documentation (e.g., copy of valid military orders) must be provided to Green Dot Bank by mailing to:

Green Dot Platinum

P.O. Box 9206

Old Bethpage, NY 11804

For questions about SCRA benefits, please call Green Dot Platinum Customer Support at 1-866-291-0818.

Continue making payments as SCRA benefits do not relieve you of your responsibility to make payments, nor do they prevent us from reporting past due payments to credit bureaus.

If you’re having trouble making your payments, please contact Customer Service.

For more information regarding your rights and responsibilities under the SCRA, visit the free SCRA verification website from the Department of Defense.